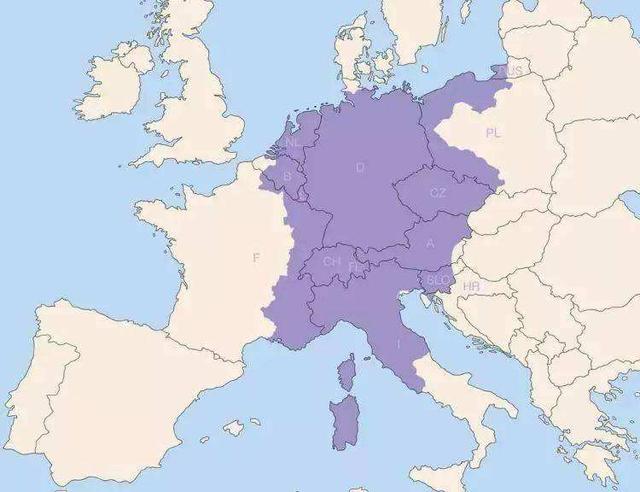

【世界上的国家品牌实力排名前十名】

一个国家的品牌实力是根据许多社会和经济因素得出的。

今年,三个新国家进入了2020年的前十名-英国,加拿大和法国。

新增加的国家将卢森堡,阿联酋和芬兰从清单中剔除。

2020年排名:

德国第一,然后依次是英国,瑞士,美国,加拿大,新加坡,日本,丹麦,法国和荷兰。暂时还没有中国。

来源:Visualcapitalist

A nation’s brand strength is calculated using a number of societal and economic factors

This year, three new nation’s made the top 10 that weren’t included in 2019— the U.K., Canada, and France

The new additions bumped Luxembourg, U.A.E, and Finland off the list

Derivatives

Two years ago, in the 2008 Annual Report, I told you that Berkshire was a party to 251 derivatives contracts (other than those used for operations at our subsidiaries, such as MidAmerican, and the few left over at Gen Re). Today, the comparable number is 203, a figure reflecting both a few additions to our portfolio and the unwinding or expiration of some contracts.

Our continuing positions, all of which I am personally responsible for, fall largely into two categories. We view both categories as engaging us in insurance-like activities in which we receive premiums for assuming risks that others wish to shed. Indeed, the thought processes we employ in these derivatives transactions are identical to those we use in our insurance business. You should also understand that we get paid up-front when we enter into the contracts and therefore run no counterparty risk. That’s important.

Our first category of derivatives consists of a number of contracts, written in 2004-2008, that required payments by us if there were bond defaults by companies included in certain high-yield indices. With minor exceptions, we were exposed to these risks for five years, with each contract covering 100 companies.

In aggregate, we received premiums of $3.4 billion for these contracts. When I originally told you in our 2007 Annual Report about them, I said that I expected the contracts would deliver us an “underwriting profit,” meaning that our losses would be less than the premiums we received. In addition, I said we would benefit from the use of float.